Enjoy a 5-star way to save

Opening a savings account should be straightforward and effortless. No long forms. No endless steps. Just a quick, hassle-free way to start hitting your savings goals.

This year we've received a 5-star rating from Moneyfacts, a trusted industry expert, for how easy it is to open one of our online savings accounts.

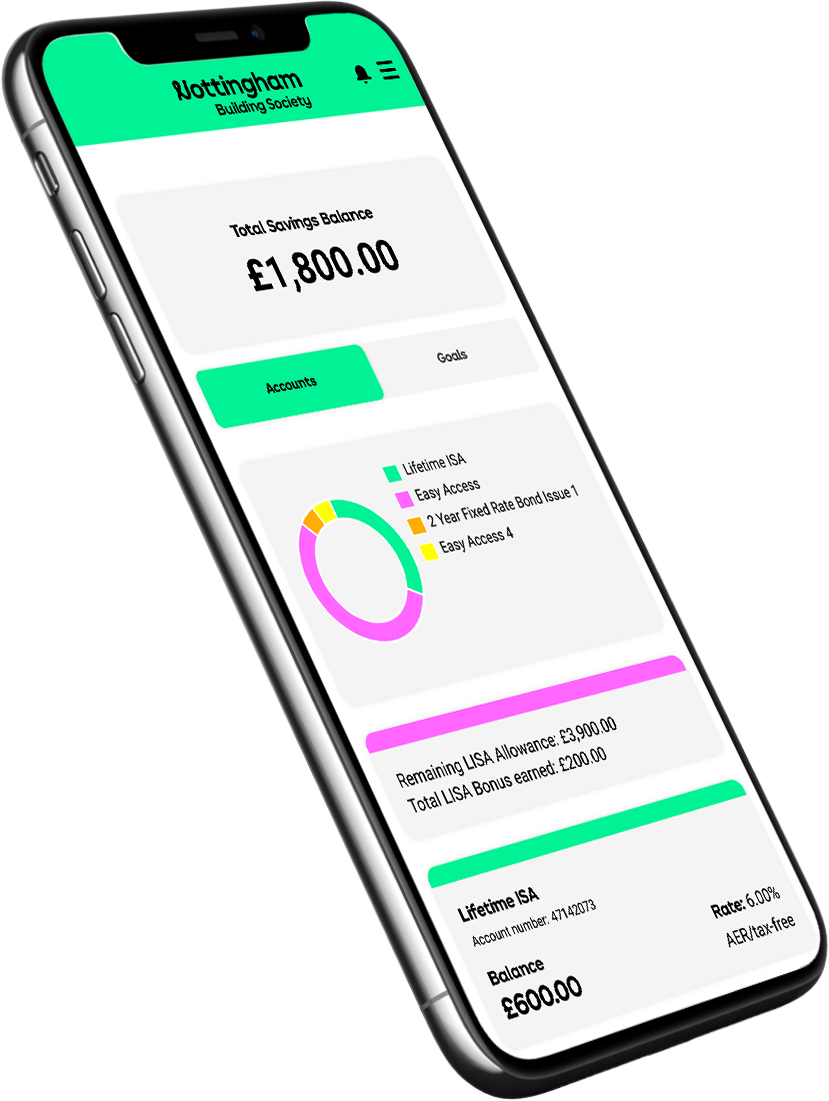

From your phone, tablet or computer, you’re only a few taps away from getting started. Why not see what all the fuss is about?

Open an online account