Protect yourself from different types of scams

Text scams

Key things to look out for

Text scams tend to have a matter of urgency in them and often have links attached. These links will take you to a page where you're asked to enter either your personal or security information, such as your password. This information is then used by the scammers to access your accounts.

Tips

Here we've listed some key things to look out for when looking for text scams.

- You're asked to follow a link. As a general rule, don’t click on links in messages.

- You're asked to hand over personal or financial details.

- It’s an unknown number. It’s unusual for genuine companies to text you from a different number to normal.

- They're asking for you to do it immediately - stop for a second and think if this could be a scam.

The best course of action is to contact the company directly through their website or a number you know and trust to check the text was genuine. It shouldn't take long and any most companies would be happy to tell you if it's a genuine text or not. Fraudsters are very good at what they do, and have found ways to spoof real companies like HMRC, so always ‘Take 5’…stop and think.

Here are some examples of the latest scam texts and ways of spotting if they're legitimate or not. If you receive one of these texts always forward these onto 7726, a number created by Ofcom to report scam texts, and then delete it.

Parking penalties

The latest scams seen are around parking fines. Parking companies quite possibly don't have your mobile number so wont be able to send you a text. If you do get a parking fine, a ticket will be left on your car or you'll receive a letter through the post that includes photographic evidence of your fine.

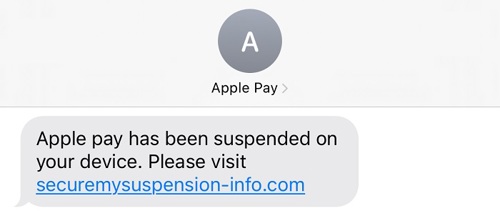

Apple Pay

This text scam informs Apple Pay users that the mobile payment service has been suspended and to reactivate it, you're required to click on a link. Clicking on this link will take you to a page which asks for your name and personal information.

Energy bill discounts

In 2024, the UK Government offered help with energy bills by providing a £400, non-repayable discount to eligible households and scammers are using this help to try and get your personal information.

The texts state that the recipient is 'owed' or 'eligible' for an energy bill discount and add a link to a genuine-looking websites, designed to steal personal and financial information.

Please note: You don't need to apply for this scheme and you will never be asked for your bank details. If you get one of these texts, always forward these onto 7726 and then delete it.

Family scams

This picture shows a conversation between a victim and the fraudster. There has been a 200% increase in these types of scams with losses exceeding £1.5m.

Sometimes dubbed the “Mum and Dad scam”, scammers contact you and impersonate family members who are in difficulty and need of money.

Key things to look out for

The scam starts with a message from an unknown number, claiming to be your loved one who has just lost their phone and got a replacement, hence the unknown number. The story they tell varies, but usually asks for money as they don’t have access to their internet/mobile banking app and need you to help pay an urgent bill.

Tips

If you or someone you know receives one of these messages, always:

- Set up a password and ask for it when you receive these messages.

- Stop - think - call. Always call the person on the number you already have for them, to check if this message came from them.

- Report the messages or block the sender within WhatsApp if this is how they've contacted you. To do this, press and hold on the message bubble, select ‘Report’ and then follow the instructions.

- Set up the two-step verification option for extra security: Tap Settings > Account >Two-step verification > Turn on.

- Never share your WhatsApp account’s 6-digit activation code.

Email scams

Email scams, as with text scams, tend to have a matter of urgency in them and often asks for your information. Always check the email address they come from as they are often not like a genuine email.

Key things to look out for

- Think before you click: It’s fine to click on links when you’re on trusted sites.

- Urgency: Fake emails will tend to have a sense of urgency, like the fact your account has been suspended

- Email address: Does the email address the email has come from look genuine?

Here are some examples of email scams and ways of spotting if they're legitimate or not:

Amazon/PayPal

Do you have an Amazon or PayPal account? Are you expecting a delivery? It's always advisable to log onto your account via the app or search the company on via a trusted browser such as Google. Any genuine message will also appear in your account. If you're still unsure contact them directly.

Pension and investment scams

Since crypto-currencies such as Bitcoin were created and the Government started to allow you more access to pension, scammers have been using these tactics to get victim's money. They often promise you high returns with little or no risk.

Here are some examples of investment scams.

Key things to look out for

Pension

- You're not allowed to access your pension funds before you turn 55, unless you have poor health.

Investment

- Scam investment tend to appear on social media and often endorsed by celebrities - Martin Lewis has said he never endorses investments.

- You’re contacted out of the blue by phone, email or social media about an investment opportunity.

- You’re told the investment opportunity is exclusive to you.

- You're pressured into signing up now and have no time for consideration.

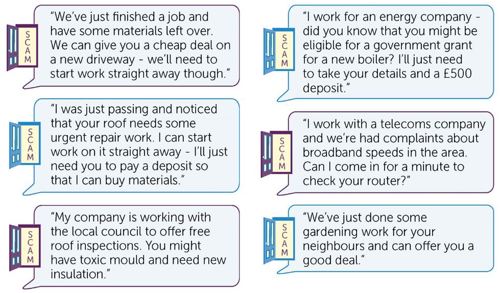

Doorstep scams

There are two types of doorstep crime, bogus callers will pose as someone that they aren’t and rogue traders who are tradespeople that don't carry out the service that they are offering.

Below are some examples of doorstep scams.

Key things to look out for

Always be suspicious of anyone turning up at the door uninvited, regardless of their story. A genuine door sales person force you to sign a contract or hand over money at the door.

Artificial Intelligence scams

AI or Artificial Intelligence scams use AI technology to con people into handing over money - just 3 seconds of your voice can be used to generate a fake video or audio recording!

Some examples of AI scams are:

- Deepfakes: This is where videos or audio pretend to be real people, either a family member asking for money or a known person to send misinformation.

- Phishing: AI can be used to create and send scam emails - gone are the days of spotting a scam email just by bad spelling alone!

- Chatbots: Fraudulent chatbots can hack into companies and create false replies to customers, either asking them to click on dodgy links or ruining a company’s reputation!

- Investment scams: AI can be used to make an investment look like its getting high returns live on the stock market - encouraging victims to invest.

Key things to look out for

AI scams are probably the most dangerous type of scam as they are hard to spot. Remember the family scam where you are contacted by a 'family member' saying they have a new number. Would you think it was a genuine message if you heard a voicemail from your family/friend saying the same thing? Most people would!

These are the sort of scenarios where AI is being used. That's why you should set up a password with your family and friends. That way, if you get a call/message from them - ask for this password and if its genuine, they will be able to tell you.

Just to show you how good these scams can be, take a look at an AI video of Martin Lewis, apparently promoting an investment scheme of Elon Musk. It is worth knowing, Martin Lewis never advertises investment schemes.

If you think you've been fallen for a scam

- Firstly, don't panic.

- Contact your bank or building society and let them know.

- Reset your passwords and update your anti-virus software.

- Report the crime to Action Fraud.

- Tell your friends and family about the scam to raise awareness.

Action Fraud |

National reporting centre for fraud and internet crime. Tel: 0300 123 2040 |

Friends Against Scams |

Offers information as well as schemes such as the Mail Marshals scheme. |

Mailing Preference Service (MPS) |

Free register for individuals who do not want to receive unsolicited sales and marketing contacts by post. |

Telephone Preference Service (TPS) |

Free opt-out service if you do not want to receive unsolicited sales and marketing telephone calls. |

Trading Standards |

To check or report a company you think has broken the law or acted unfairly |

CIFAS |

Provide a registration service to protect you if your details have been stolen. |

Royal Mail |

If you or someone you know is receiving scam mail in the post, you can report it to the Royal Mail. You can post your letter directly to FREEPOST SCAM MAIL. Tel: 03456 113 413 |

Citizens Advice |

National network of advice centres offering free, confidential and independent advice face-to-face or by telephone. |