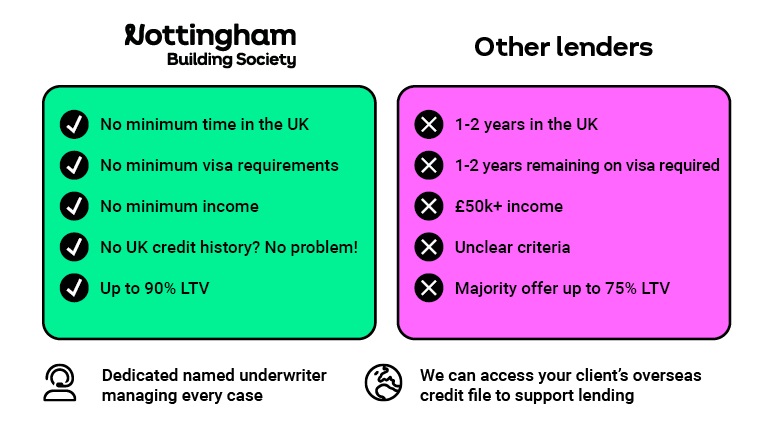

We know foreign nationals and expats returning to the UK find it tough to get a mortgage. So, we've ditched the restrictive criteria and built a unique proposition.

Who it’s for?

- Foreign nationals on a visa with a route to permanent residency, already living and working in the UK.

- Applicants returning to the UK who are purchasing a main residence.

- Residential purchase and remortgage only.

Key criteria

Where no credit data is available we will manually underwrite cases to a maximum LTV of 75%.

Does my customer qualify?

| Product features | |

| Product range |

Foreign nationals and returning expats is a separate product rate. Not for standard residential products.

|

| LTV |

|

| Criteria | |

| Residency: Foreign nationals |

|

| Residency: Expats |

|

| Nationality |

|

|

Income |

|

| Affordability |

|

| Deposit |

|

What maximum LTV will be applicable to my customer?

The maximum LTV we can offer will depend on availability of UK and overseas bureau data. This is outlined below.

| Scenario | Maximum LTV | Application steps |

|

Passes UK Experian check Sufficient UK data (min. two years’ credit history) Subject to standard credit decisioning rules |

90% |

Will show as a PASS at DIP stage and can proceed with application. Underwriter will then contact the broker with a list of requested documents. |

|

Credit file is available from overseas bureau partner Customer has come to the UK from one of the following countries AND has sufficient credit data from this country: Australia, Austria, Canada, Dominican Republic, Philippines, Germany, India, Kenya, Mexico, South Korea, Spain, Switzerland, United States. Subject to credit decisioning rules. Where data is not available, max LTV will be 75%. Note – we do not have full CRA coverage in any country so in some cases will be unable to source data |

90% |

Where we have insufficient UK data, will show as a REFER in Broker Portal at DIP stage. Please do not re-try as this will not change the REFER status. Underwriter will contact broker at the point of instigating the overseas search. Customer will receive email from our bureau partner with instructions. Underwriter will contact broker to confirm next steps once credit data is received. |

|

Where no UK credit data AND no overseas data Customer is from outside of the countries covered by our overseas bureau partner. OR No data available following overseas search. |

75% |

Will be subject to more detailed manual underwrite. Underwriter will contact the broker with list of requested information and documents. |

Applicants

We will accept applications from foreign nationals resident in the UK who hold a visa with a route to permanent residency within the UK. Examples include:

- Health & Care Worker.

- Skilled Worker.

- Global Talent.

- Pre-settlement.

- UK Ancestry.

- British National Overseas.

- Tier 2 (if granted before 1st Dec 2020).

- Dependant (as a joint applicant).

There is no requirement for these applicants to have been in the UK for a minimum period, or for applicants to have a minimum term remaining on the visa.

Visas can either be verified by providing the Share Code (Home Office Service) or with a copy of the visa and accompanying letter.

All nationalities and countries will be considered but there may be some enhanced due diligence required with the application. This will be clearly outlined when the DIP is approved.

Products are for residential purchase or remortgage only. For foreign nationals we require the customer to be already in the UK. For returning expats, customers may begin an application from overseas but must be in the UK by the time we issue the mortgage offer.

Yes, they will be able to apply for our standard product switch rates. We won’t have the enhanced rates for product switches.

Submitting an application

Within our broker portal, click on 'Specialist Products’ button, then you will be presented with several specialist products (foreign nationals, expats, professionals).

You will have the option to start a purchase, remortgage or PMI.

Within this page, you will find specific application buttons for foreign national or expat.

Note – when inputting overseas addresses, these will need to be input manually. There may be validation errors on screen but you can still proceed with the application.

Our underwriters will contact brokers at the point of instigating the overseas search.

Customers will receive an email from our bureau partner, which will be co-branded from Nottingham Building Society. Customers will click on a link to take them to the bureau partner’s portal, following which the customer will need to confirm their identity and pass authentication checks.

All of this is done online and will vary from country to country depending on individual CRA requirements and types of identify documentation available in specific countries.

Please note, for security reasons, the customer will have 72 hours to instigate the process.

The deposit must be held in a UK bank account at the time of application. Further verification may be required if the amount and source of deposit is inconsistent with the applicant’s financial profile.

We allow customers applying for a foreign national or returning expat mortgage to use builders’ incentives of up to 5% towards securing a deposit on a UK new build property.

Please only include UK based dependants in the ‘number of dependents’ field in the affordability calculator.

Any funds sent to overseas dependants should be included as additional expenditure.

The affordability assessment is based on UK income only and we can’t accept any overseas or foreign currency income.

Evidence of income and additional documentation will be required dependent on the applicant type. An email will be sent by an underwriter when the DIP is approved with a clear list of requirements, and documents should be uploaded to the broker portal.

Scenarios

You can apply in sole or joint names. If applicant 2 is not working, affordability will be based on applicant 1's income. In the case of a sole application, we would need to consider where the deposit was coming from and applicant 2 may need legal advice regarding the deposit if they were contributing.

Yes, that’s fine, although any funds that are transferred to India for dependants will need to be included in expenditure.

Where an applicant has not been employed for three months, we are able to consider a case if the applicant has been in the same line of work previously. For example, if they have been employed in healthcare overseas and have moved to the UK to work in healthcare here. In this scenario, we would require evidence of their previous employment.

In this scenario, a DIP can be submitted but we would need to see evidence (such as a pay slip) that the applicant has started their new role with the application.